I've liked this poem "Desiderata" by Max Ehrmann since I first saw it in college in Baltimore. I know it's a bit sentimental and cliched, and I realize it wasn't really discovered in a church but whatever, most origin stories are BS. It doesn't take anything away from the experience.

Another sentimental cliche is that this is the time of year when family gets together and fight. We seem to do that everyday in our household. But I've never had the seemingly most cliched Thanksgiving experience of arguing radical politics or having the "crazy uncle" thing. I adore my uncles, though sadly I lost one this year. Even then, I'm grateful that I knew him. He was an outlier in many ways. At his funeral my aunt, herself a published author, read something from his journal about a simple question frequently asked in his younger days "could we ... ? " evolving with time and experience to "should we ... ?"

It seems relevant to reflect on this question in an era of fast paced technological change (crspr, AI, self driving cars, drones and weaponry, etc.). Should we have left fire in the domain of nature? Of course not. I think we should ... as responsibly as possible ... understanding that there's a learning curve and we're likely to burn ourselves early on.

***

I write here not about technology but with Thanksgiving and "gratitude" in mind. However, it would be disingenuous to honor those virtues without acknowledging the range of other emotions that seep into investing life when expectations aren't met: Anger, impatience and fear.

In thinking about both gratitude and anger, I acknowledge posts I've written here (as well as other "Dear Chairman" letters I haven't) that were written with too much of the latter and not enough of the former. In some cases I regret it and have apologized. In other cases, sharp words can help hold executives accountable to their shareholders when they hide their failures and lies behind silence.

But it would be ridiculous to not acknowledge the gratitude as well. I'm grateful for clients. I'm grateful for the returns. I'm grateful for the executives who manage our companies wisely and with integrity to enable those returns, and those who acknowledge their shortcomings and adapt when they are wrong, because course correction is always an option. I'm even grateful for the mistakes that I've learned from, as humbling as they can be.

Today should be a reminder that a little gratitude can help us all aim more accurately towards equanimity, to help make better decisions, to improve process, to better steward ours' and our clients' capital and to compound the value of investments for the long term. These attributes will enable business longevity and durability, two things I want, along with growing my client base and continuing to compound returns.

As the poem reminds us, "... many fears are born of fatigue." That and days when the indexes are down 500 points or large holdings decline 20%. At the very least we can be grateful to have a place to sleep, so we can wake refreshed and prepared for tomorrow, whatever it brings.

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

"you do you!" musings and observations about investing and sports and other editorial cuts

Thursday, November 22, 2018

Thursday, November 15, 2018

QRHC decision tree, b/c making decisions while frustrated is bad

If QRHC had never issued '18 guidance and reported $2M-$2.5M in EBITDA this year, investors would have been happy. B/c let's not forget first and foremost, this company has done a really good job to date turning this business profitable.

However, they did issue guidance and they've fumbled in their own end zone mismanaging "the street". Here's a brief history of guidance ...

11/14/17 (3Q17 report) >> "Based on the aforementioned, we expect revenue growth for 2018 to be between 10% and 15%, driving positive net income with estimated GAAP earnings between $2 million and $3 million, or GAAP earnings per share between $0.13 and $0.20, and estimated non-GAAP Adjusted EBITDA between $6 million and $7 million, or non-GAAP Adjusted EBITDA per share between $0.39 and $0.46. Per share estimates are based upon the issued and outstanding common shares as of September 30, 2017. Before the full effect of our strategic shift is reflected commencing in 2018, we anticipate that earnings for the transitional fourth quarter of 2017 will be relatively flat with the third quarter.”

Either you can assume the Chairman who owns a lot of this company wants to make money, is reasonable, will start asking questions and invest in a solution. Properly implemented and utilized, the right tech platform would enable this company to scale significantly and generate fcf with little required re-investment.

I'm sure that if they'd never opened their mouths on guidance, we'd never be here and all this speculation would be unnecessary. But here we are, on the clock, mgmt has gnawed it's credibility to zero and this is now a "show don't tell" story. Investors must choose their own adventure.

-- END --

However, they did issue guidance and they've fumbled in their own end zone mismanaging "the street". Here's a brief history of guidance ...

11/14/17 (3Q17 report) >> "Based on the aforementioned, we expect revenue growth for 2018 to be between 10% and 15%, driving positive net income with estimated GAAP earnings between $2 million and $3 million, or GAAP earnings per share between $0.13 and $0.20, and estimated non-GAAP Adjusted EBITDA between $6 million and $7 million, or non-GAAP Adjusted EBITDA per share between $0.39 and $0.46. Per share estimates are based upon the issued and outstanding common shares as of September 30, 2017. Before the full effect of our strategic shift is reflected commencing in 2018, we anticipate that earnings for the transitional fourth quarter of 2017 will be relatively flat with the third quarter.”

4/2/18 (4Q17 report) >> "Quest currently expects positive net income during 2018 with estimated GAAP earnings between $500,000 and $3 million, or GAAP earnings per share between $0.03 and $0.20, and estimated non-GAAP Adjusted EBITDA between $4 million and $7 million, or non-GAAP Adjusted EBITDA per share between $0.26 and $0.46. Per share estimates are based upon the issued and outstanding common shares as of December 31, 2017."

5/13/18 (1Q18 report) >> ""First quarter results were in line with our expectations, and the previously delayed customer implementations are beginning to ramp and contribute to sequential revenue and earnings growth.” said S. Ray Hatch, President and Chief Executive Officer. “We are building a significant pipeline of new business and expect new innovative programs, such as the one we announced with Shell, to provide significant growth opportunities. We have made progress toward our annual targets and expect to show improvement throughout the year.” ... on the call it was added ... "We're on track to meet our goals for 2018 which I'll remind everyone is an adjusted EBITDA of $4 million to $7 million."

8/14/18 (2Q18 report) >> "In addition, we have built a significant pipeline of new business that we expect will lead to significant incremental growth during the second half of the year. Based on the continuing ramp of business with existing customers, our expanding pipeline of new business, and the earnings leverage in our business, we believe that we are on target to reach $4 million in Adjusted EBITDA for 2018.”

And then on the call ... "Although, it looks like we’ll have a ways to go to meet the lower end of the $4 million EBITDA number on our target, we showed significant progress towards that target in the second quarter, and are definitely moving in the right direction when it comes to showing sustainable improvement in our financial performance ... We’ve also built a significant pipeline during the first half that gives us visibility to continue sequential growth in the second half of 2018 and lays the groundwork for double-digit growth in 2019."

Plus the CFO says ... "I don’t remember ever putting out $3 million on the net income." (??!)

11/13/18 (3Q18 report) >> "We now expect Adjusted EBITDA will be approximately $2.0 million to $2.5 million for the year 2018, which would represent a substantial increase of 150% to 200% over last year and set a new record for annual operating performance."

... and here we are, frustrated and disappointed, two feelings that generally lead to poor decisions. What information can we derive from this guidance fiasco?

The generous view:

They just don't understand the ebbs / flows of new customer ramps

They aren't experienced as pubco execs and don't understand how to "manage the street"

The less generous view:

They have no visibility into their business b/c their IT platform doesn't enable them to access real time invoice management

I lean most towards the lack of visibility due to weak IT platform, b/c that's what my due diligence tells me, and its reinforced by the fact that halfway through the quarter, they have no sense of whether sequential EBITDA is going to be up or down.

It's not a problem to not know tech, but it's a problem to not fix it.

The generous view:

They just don't understand the ebbs / flows of new customer ramps

They aren't experienced as pubco execs and don't understand how to "manage the street"

The less generous view:

They have no visibility into their business b/c their IT platform doesn't enable them to access real time invoice management

Chairman (or some other shareholder) encouraged them to state absurd stupid guidance so they could sell

The least generous view:

They are liars and will say anything

They are clueless

It's not a problem to not know tech, but it's a problem to not fix it.

You want to succeed in life? Acknowledge your weaknesses and work to fix them. Find people who pay attention who can provide honest critical feedback and then work towards fixing it. Everything is solvable. But if you don't acknowledge what you're bad at, you'll never ever overcome it.

So what do investors do now?

Either you can assume the Chairman who owns a lot of this company wants to make money, is reasonable, will start asking questions and invest in a solution. Properly implemented and utilized, the right tech platform would enable this company to scale significantly and generate fcf with little required re-investment.

Or you can not waste your time b/c you're not getting water from a rock, especially the one the Chairman lives beneath.

Regardless of what happens to the stock over the next year, you have to be able to look back and say "I made the right choice with all the information available."

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Wednesday, November 7, 2018

LCA 3Q18 Letter

Returns rebounded in 3Q18. My letter to clients is posted on my website here. It includes thoughts on existing positions and two new ones towards which we've allocated some of the proceeds on the sale of IVTY.

I briefly mentioned towards the end of the letter how helpful it's been for me to re-read Chapter 8 of the Psychology of Intelligence Analysis, by Richards J. Heuer, Jr. That chapter deals with "Analysis of Competing Hypotheses" and lays out such a simple but deep method for assessing such things. The whole book is an amazing read.

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

I briefly mentioned towards the end of the letter how helpful it's been for me to re-read Chapter 8 of the Psychology of Intelligence Analysis, by Richards J. Heuer, Jr. That chapter deals with "Analysis of Competing Hypotheses" and lays out such a simple but deep method for assessing such things. The whole book is an amazing read.

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Saturday, October 20, 2018

Not so revolutionary thinking (RVLT)

Revolution Lighting was on my radar in 2016 when I was lucky enough to pass on the stock. I did some due diligence, talked to a lighting expert (babysitter's dad) and then after speaking with the Chairman's son, I wrote this email (or at least this is how it started) but never sent it b/c it wasn't worth my time polishing a message for a company that didn't interest me and certainly wouldn't have been worth their time reading it ...

... etc. Now here we are two years on with a bit of strangeness around a company run by an extremely seasoned mgmt team that's well versed in the capital markets but isn't called Sears.

Last week this closely owned company pre-announced 3Q18 results and the Chairman disclosed a takeunder offer at $2. The stock closed that day ~$1.50, where it remains. On Friday, they offered "clarity" on the pre-announcement: Blamed timing, but it's also having internal shipping issues; disclosed a pretty minor SEC investigation into revenue recognition practices; and elaborated on cash flow needs that will get it through the year.

I write here not to dig into the company but to organize and explore my thinking around a potential investment decision. It strikes me as a wonderful and simple little puzzle, an investment koan. To tee it up, we're talking about investing in a not so great business whose stock trades at $1.50 with a presumably legitimate $2 takeout on the table.

1. "Life's Too Short". I've been working on my checklist and that's item #1. So I'll put it at #1 here too. This means two things. First, do I want to spend my time on this at all? (Apparently I can't help myself.) Secondly ... well, I'll add that below.

2. Are they scientologists? Who uses the term "clarity"? Would a business run on the principles of scientology create value for shareholders?

2. What's the business worth? On paper, its got a ~$100M EV ($40M mkt cap / $60M net debt owed to Chairman) and trades at ~2x gross profits vs +3x gross profits two years ago when investors still had faith and confidence in the LaPentas.

What do other deals in the space go for? What has RVLT paid for its acquisitions? What would a private company reasonably pay for the distribution business and the gov't contracts? Who can I talk with to help me quickly get the pulse of those multiples?

3. What are my assumptions and how reasonable are they? What are the potential outcomes and how probable are they?

4. I should add to my checklist something etched into the wall of an old bklyn heights bank: "Society is based on faith and confidence in one another's integrity". I think of faith and confidence as non-balance sheet assets. Here they've been fully impaired, but over time and under different mgmt could be restored.

5. How would I feel buying the stock if the deal is pulled? How can I weigh that against the feeling I'd have not buying the stock and the deal goes through? I know we're supposed to table our feelings but it's on my mind. The behaviorists must have a term for this.

6. Maybe the solution is to buy a small position. But then, why bother with small positions? That's something to think about some other time.

7. Finally, getting back to "Life's Too Short", Robert LaPenta, the Chairman & CEO of the company, was deathly ill in Spring '18. Maybe he's come to the same conclusion? Maybe he wants out and the takeunder implies he will accept any offer over $2? I find this the most compelling explanation for all of this behavior. I wonder if is is their most desired outcome?

I think this encompasses most of my thinking. I've spent enough time on this and likely so have you. "Life's Too Short!"

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

... etc. Now here we are two years on with a bit of strangeness around a company run by an extremely seasoned mgmt team that's well versed in the capital markets but isn't called Sears.

Last week this closely owned company pre-announced 3Q18 results and the Chairman disclosed a takeunder offer at $2. The stock closed that day ~$1.50, where it remains. On Friday, they offered "clarity" on the pre-announcement: Blamed timing, but it's also having internal shipping issues; disclosed a pretty minor SEC investigation into revenue recognition practices; and elaborated on cash flow needs that will get it through the year.

I write here not to dig into the company but to organize and explore my thinking around a potential investment decision. It strikes me as a wonderful and simple little puzzle, an investment koan. To tee it up, we're talking about investing in a not so great business whose stock trades at $1.50 with a presumably legitimate $2 takeout on the table.

1. "Life's Too Short". I've been working on my checklist and that's item #1. So I'll put it at #1 here too. This means two things. First, do I want to spend my time on this at all? (Apparently I can't help myself.) Secondly ... well, I'll add that below.

2. What's the business worth? On paper, its got a ~$100M EV ($40M mkt cap / $60M net debt owed to Chairman) and trades at ~2x gross profits vs +3x gross profits two years ago when investors still had faith and confidence in the LaPentas.

What do other deals in the space go for? What has RVLT paid for its acquisitions? What would a private company reasonably pay for the distribution business and the gov't contracts? Who can I talk with to help me quickly get the pulse of those multiples?

3. What are my assumptions and how reasonable are they? What are the potential outcomes and how probable are they?

4. I should add to my checklist something etched into the wall of an old bklyn heights bank: "Society is based on faith and confidence in one another's integrity". I think of faith and confidence as non-balance sheet assets. Here they've been fully impaired, but over time and under different mgmt could be restored.

5. How would I feel buying the stock if the deal is pulled? How can I weigh that against the feeling I'd have not buying the stock and the deal goes through? I know we're supposed to table our feelings but it's on my mind. The behaviorists must have a term for this.

6. Maybe the solution is to buy a small position. But then, why bother with small positions? That's something to think about some other time.

7. Finally, getting back to "Life's Too Short", Robert LaPenta, the Chairman & CEO of the company, was deathly ill in Spring '18. Maybe he's come to the same conclusion? Maybe he wants out and the takeunder implies he will accept any offer over $2? I find this the most compelling explanation for all of this behavior. I wonder if is is their most desired outcome?

I think this encompasses most of my thinking. I've spent enough time on this and likely so have you. "Life's Too Short!"

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Monday, September 17, 2018

CTEK: Letter to Management

Over the weekend, I mailed a letter to CTEK management asking them to please consider selling the MPS business so that they can focus on the high return IT Consulting / Cybersecurity business. The math on the two businesses just doesn't make sense for a company this small and undercapitalized and the MPS returns are too low to justify any incremental spend; they should spend all incremental capital growing their IT business.

Then a press release came to my attention that might indicate a willing buyer. If a sale could draw $25M, basically what the pure play MPS was worth a few years back, and the proceeds are allocated towards debt paydown, it would leave investors with a high margin, FCF generating pure play IT consulting / cybersecurity business trading for less than 6x EBITDA.

This is why I think CTEK increasingly looks like a “good co / bad co” situation, with the legacy MPS business hiding the value of the smaller- and faster-growth IT Cybersecurity business.

With a sale of the MPS business, management would have optionality, and the next best thing to $0.50 on the $1 is optionality. They can grow organically, by slow acquisition or via a reverse merger with a larger private company with pubco ready executives who want to roll up in this fragmented industry. I think the last option offers the best opportunity for investors, customers and employees, especially given the need to manage succession planning at CTEK as well.

I know I prefer investments where I can own the stock and never have to think about it again, but my attention gets focused when our holdings underperform their own expectations. When a reasonable and probable solution exists, I will always fight for mine and my clients' capital.

Here is the full text of the letter to the Chairman, JD Abouchar ...

Dear JD:

I am the owner, for myself and clients, of 100,000 shares of Cynergistek stock. I own these shares because I believe the market significantly undervalues the fast growing, high margin IT Security business that is over shadowed by its larger MPS cousin.

I write to urge the Board to maximize the valuation of the enterprise, and to ensure a strong, durable foundation for long term profitable growth, by selling the MPS business and expanding the pure play IT Security business through a reverse merger with a larger, highly regarded competitor.

I believe these steps would offer shareholders the potential for material value recognition, would provide customers the most focused service solutions and would ensure employees a more stable work environment within a fast growing high margin business.

I come to this conclusion upon the realization of three issues:

• Despite the best intentions of holding both MPS and IT Security under one-roof, we are too small and under-capitalized to invest in both concurrently.

• Every dollar we invest in IT returns substantially more than an investment in MPS so it makes no sense to allocate incremental capital into the low return, slower growth business.

• Mac, our CEO, who built, grew and has already sold his business once, wants to retire. We need to find a dynamic pubco ready, lights out CEO to shepherd the business through its next leg of growth.

The good news is, we have assets and optionality, and immediate value could be realized by selling the MPS business. In 2015, as a standalone pureplay MPS, “Auxilio” had a $25M mkt cap on $60M revenues and $1.6M EBITDA. Today, that business, still around the same size but freed from public company expense, would be worth roughly the same to a strategic or a financial buyer.

Assuming a sale in that price range with the proceeds allocated to debt paydown, shareholders would be left with a fast growing, standalone IT Security / Consulting / Staffing business, with ~$5M in EBITDA, trading at less than 6x Enterprise Value, undoubtedly on the low end of the valuation range for a company with strong FCF potential.

From this foundation, I see three ways to grow our IT Cybersecurity / Consulting business into a larger pure play entity, providing broader solutions to more customers, potentially in allied verticals such as academia and government.

• Via slow, patient and organic growth

• Via a handful of “bolt on” acquisitions

• Via a reverse merger with larger well-respected competitor with an existing management team intent on consolidating the mid-sized market and benefitting from capital markets exposure.

All scenarios require thorough due diligence and carry risk, but I believe the last offers the most expedient way to satisfy growth, durability and succession planning.

I don’t imagine I am telling you anything new. I came to these conclusions simply by contemplating the business and considering the best paths forward. I imagine the Board regularly does the same.

Whatever choice is made, I urge members of the Board to individually invest in the decided outcome with their own personal capital. We outside shareholders who endow our faith in Board decisions fairly deserve to see such mutual faith abided.

Sincerely ...

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Then a press release came to my attention that might indicate a willing buyer. If a sale could draw $25M, basically what the pure play MPS was worth a few years back, and the proceeds are allocated towards debt paydown, it would leave investors with a high margin, FCF generating pure play IT consulting / cybersecurity business trading for less than 6x EBITDA.

This is why I think CTEK increasingly looks like a “good co / bad co” situation, with the legacy MPS business hiding the value of the smaller- and faster-growth IT Cybersecurity business.

With a sale of the MPS business, management would have optionality, and the next best thing to $0.50 on the $1 is optionality. They can grow organically, by slow acquisition or via a reverse merger with a larger private company with pubco ready executives who want to roll up in this fragmented industry. I think the last option offers the best opportunity for investors, customers and employees, especially given the need to manage succession planning at CTEK as well.

I know I prefer investments where I can own the stock and never have to think about it again, but my attention gets focused when our holdings underperform their own expectations. When a reasonable and probable solution exists, I will always fight for mine and my clients' capital.

Here is the full text of the letter to the Chairman, JD Abouchar ...

Dear JD:

I am the owner, for myself and clients, of 100,000 shares of Cynergistek stock. I own these shares because I believe the market significantly undervalues the fast growing, high margin IT Security business that is over shadowed by its larger MPS cousin.

I write to urge the Board to maximize the valuation of the enterprise, and to ensure a strong, durable foundation for long term profitable growth, by selling the MPS business and expanding the pure play IT Security business through a reverse merger with a larger, highly regarded competitor.

I believe these steps would offer shareholders the potential for material value recognition, would provide customers the most focused service solutions and would ensure employees a more stable work environment within a fast growing high margin business.

I come to this conclusion upon the realization of three issues:

• Despite the best intentions of holding both MPS and IT Security under one-roof, we are too small and under-capitalized to invest in both concurrently.

• Every dollar we invest in IT returns substantially more than an investment in MPS so it makes no sense to allocate incremental capital into the low return, slower growth business.

• Mac, our CEO, who built, grew and has already sold his business once, wants to retire. We need to find a dynamic pubco ready, lights out CEO to shepherd the business through its next leg of growth.

The good news is, we have assets and optionality, and immediate value could be realized by selling the MPS business. In 2015, as a standalone pureplay MPS, “Auxilio” had a $25M mkt cap on $60M revenues and $1.6M EBITDA. Today, that business, still around the same size but freed from public company expense, would be worth roughly the same to a strategic or a financial buyer.

Assuming a sale in that price range with the proceeds allocated to debt paydown, shareholders would be left with a fast growing, standalone IT Security / Consulting / Staffing business, with ~$5M in EBITDA, trading at less than 6x Enterprise Value, undoubtedly on the low end of the valuation range for a company with strong FCF potential.

From this foundation, I see three ways to grow our IT Cybersecurity / Consulting business into a larger pure play entity, providing broader solutions to more customers, potentially in allied verticals such as academia and government.

• Via slow, patient and organic growth

• Via a handful of “bolt on” acquisitions

• Via a reverse merger with larger well-respected competitor with an existing management team intent on consolidating the mid-sized market and benefitting from capital markets exposure.

All scenarios require thorough due diligence and carry risk, but I believe the last offers the most expedient way to satisfy growth, durability and succession planning.

I don’t imagine I am telling you anything new. I came to these conclusions simply by contemplating the business and considering the best paths forward. I imagine the Board regularly does the same.

Whatever choice is made, I urge members of the Board to individually invest in the decided outcome with their own personal capital. We outside shareholders who endow our faith in Board decisions fairly deserve to see such mutual faith abided.

Sincerely ...

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Friday, August 17, 2018

LCA 2Q18 Letter + thoughts on the problems we investors are trying to solve

LCA posted negative consolidated returns in 2Q18 and YTD. I wrote some reflections in the quarterly letter, here. I started that letter probably two months ago, and it grew (and grew, and grew) before I cut it back to the final 2,000 words.

Here's something I cut out of it, but wanted to share somewhere. It touches on the chasm between the way a sell side analyst thinks about analysis vs how a share owner thinks about value ...

"The things important to the sell side (typically revenue growth and margin expansion) are vastly different than what's important as a stock buyer. My first inkling of that difference came from a client at Pyramis. He always asked good challenging questions in this friendly laconic way, and occasionally shared his thinking on stocks.

This must've been '10 and we were talking Emcor (EME), a wonderfully managed specialty construction company, then trading in the high teens / low twenties. I'd analyzed that company for years, knew it in and out. I'd even identified correlations b/t labor statistics for mechanical and electrical subcontractors and growth rates and used it to set quarterly earnings forecasts. Such things are important on the sell-side.

So I was pretty dialed-in on those specifics and on the stock in general, but I didn't see any reason to buy it. There was no pending growth acceleration. No weather that seasonally drove up the business. No major infrastructure bills.

I asked what drove his interest and he told me, quite simply, that it was a great well managed company that seemed cheap with a terrific CEO [Tony Guzzi]. He got no disagreement from me, I just questioned the timing.

Sometime after, I reflected on that conversation, I realized something critically important; He wasn't interested - as 90% of my other clients were - with next quarter's "beat and raise". The problem he and other long term oriented PM's are trying to solve is finding good companies to own, that could be owned for years, that weren't going to keep him up at night and had a high probability that it would grow in value over time.

I definitely wasn't aware of the term "compounder" at the time, b/c I had my head so far up the ass of "rev growth and margin expansion", but that's essentially what he was going for. Over time, I realized I wanted to be more like him someday.

Once I left the sell side, the first stock I bought that I hadn't previously covered (ARIS) was attractive to me b/c I'd seen evidence of management's ability to create long term value in the form of BVPS excluding-goodwill.

Ask a sell sider to analyze growth in BVPS and they'll probably ask why that matters but on this side of the desk, it is dear. The consistent creation of value evident over time on a balance sheet is one of the most important elements to consider for long term investors."

... waking up to that difference was a growth moment for this investor.

And now we come to this quarter and this YTD, where performance is offering more lessons. Specifically, questions like, what happens if the companies we own aren't generating long term growth and value as expected? What if management and the board start making choices and decisions that conflict with our principles of long term value creation? Even worse, what if they've been making poor choices all along, and we just didn't recognize it?

Due diligence is an ongoing process. Mine is not directed towards "next quarter's earnings" but what's actually happening at the company - with operations, customer satisfaction, culture - to assess whether management remains focused on the l/t drivers of value vs short term success. I hope I'm getting it right over the long term. I know I'm spending a lot more time than ever thinking about the differences between the research process, the portfolio management process, the valuation process and the ongoing appraisal process.

--

One thing I can say for certain with "long term growth in value" is that you have to be content sitting for years owning shares in companies whose operations consistently improve and whose stocks do nothing, or even decline.

Here's the BVPS of two companies we've recently been investing in (still buying them so going to remain vague on tickers) ...

... the top chart is for a company that's been investing pretty consistently since '05 a cumulative $35M in a software style platform that is finally bearing fruit. The big jumps in the early '00's and in '14 represent sales of earlier businesses.

The stock has gone in hockey stick mode ... but when you read 10-years of financials and five years of conference calls ... I see evidence that they are rational investors who've been focused for quite some time on building a pretty interesting and hard to replicate platform.

For the company to generate a positive IRR on their +$35M cumulative investments, I estimate it needs to generate profits well north of $20M. So while the stock is expensive against this year's annualized income, against that long term "bogey", it remains quite cheap. And based on talking with experts in the industry, its offering is in quite high demand.

The bottom chart shows BVPS for a company whose current CEO joined in '12, did a major writedown / restructuring and identified one strategy that's bore fruit in '17 and another strategy that they think could bear fruit in '19 (but who knows?).

It's been a terrible stock on account of impossible y/y comps that will continue through 2018. Plus, it's a capital equipment provider in the chip space, so you've got that cyclicality. Their equipment does a fairly commodity task of programming chips. Lots of companies do this. But ... there's more data going into chips + there's an idea that security needs to be programmed into the "root" of a chip = separation between competitors based on speed, reliability and access to security IP.

They've locked up some pretty good IP; in a convo with a frenemy, their technology is solid. Their partner who supplies the IP in the security offering was recently acquired for +$30M valuation (on less than $1M sales). If the buyer wants to get a return on that investment they need our company to produce more equipment.

And all they do, all the time is think about putting value into / squeezing value out of this niche business of providing their capital equipment used to program chips. They solve problems for electronics distributors (Arrow, Avnet, etc) and automotive suppliers (Bosch, Johnson, etc), who need fairly small scale (< 10M) units programmed.

It might remain a terrible stock through 2H18. It might be a terrible stock until their security offering starts to work. That security offering might not work until regulations change.

It might be a terrible stock even when it does start to work, b/c they won't be booking large equipment sales but rather high margin pennies per chip sales. But it seems inexpensive relative to it's future opportunity and it's growing installed base.

Like anything else, both of these companies are investments in unknown and unknowable futures. That they are both managed by teams that have long been focused - and demonstrated an ability to generate - value creation offers the outside investor at least something to hang their hat on, and solve that problem I recognized we investors all face, long ago.

-- END --

ALL RIGHTS RESERVED. PLEASE DO NOT COPY OR RE-DISTRIBUTE WITHOUT PERMISSION. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT IN THE COMPANIES MENTIONED HERE, WHICH I MAY BUY, OWN OR SELL AT ANY TIME.

Here's something I cut out of it, but wanted to share somewhere. It touches on the chasm between the way a sell side analyst thinks about analysis vs how a share owner thinks about value ...

"The things important to the sell side (typically revenue growth and margin expansion) are vastly different than what's important as a stock buyer. My first inkling of that difference came from a client at Pyramis. He always asked good challenging questions in this friendly laconic way, and occasionally shared his thinking on stocks.

This must've been '10 and we were talking Emcor (EME), a wonderfully managed specialty construction company, then trading in the high teens / low twenties. I'd analyzed that company for years, knew it in and out. I'd even identified correlations b/t labor statistics for mechanical and electrical subcontractors and growth rates and used it to set quarterly earnings forecasts. Such things are important on the sell-side.

So I was pretty dialed-in on those specifics and on the stock in general, but I didn't see any reason to buy it. There was no pending growth acceleration. No weather that seasonally drove up the business. No major infrastructure bills.

I asked what drove his interest and he told me, quite simply, that it was a great well managed company that seemed cheap with a terrific CEO [Tony Guzzi]. He got no disagreement from me, I just questioned the timing.

Sometime after, I reflected on that conversation, I realized something critically important; He wasn't interested - as 90% of my other clients were - with next quarter's "beat and raise". The problem he and other long term oriented PM's are trying to solve is finding good companies to own, that could be owned for years, that weren't going to keep him up at night and had a high probability that it would grow in value over time.

I definitely wasn't aware of the term "compounder" at the time, b/c I had my head so far up the ass of "rev growth and margin expansion", but that's essentially what he was going for. Over time, I realized I wanted to be more like him someday.

Once I left the sell side, the first stock I bought that I hadn't previously covered (ARIS) was attractive to me b/c I'd seen evidence of management's ability to create long term value in the form of BVPS excluding-goodwill.

Ask a sell sider to analyze growth in BVPS and they'll probably ask why that matters but on this side of the desk, it is dear. The consistent creation of value evident over time on a balance sheet is one of the most important elements to consider for long term investors."

... waking up to that difference was a growth moment for this investor.

And now we come to this quarter and this YTD, where performance is offering more lessons. Specifically, questions like, what happens if the companies we own aren't generating long term growth and value as expected? What if management and the board start making choices and decisions that conflict with our principles of long term value creation? Even worse, what if they've been making poor choices all along, and we just didn't recognize it?

Due diligence is an ongoing process. Mine is not directed towards "next quarter's earnings" but what's actually happening at the company - with operations, customer satisfaction, culture - to assess whether management remains focused on the l/t drivers of value vs short term success. I hope I'm getting it right over the long term. I know I'm spending a lot more time than ever thinking about the differences between the research process, the portfolio management process, the valuation process and the ongoing appraisal process.

--

One thing I can say for certain with "long term growth in value" is that you have to be content sitting for years owning shares in companies whose operations consistently improve and whose stocks do nothing, or even decline.

Here's the BVPS of two companies we've recently been investing in (still buying them so going to remain vague on tickers) ...

... the top chart is for a company that's been investing pretty consistently since '05 a cumulative $35M in a software style platform that is finally bearing fruit. The big jumps in the early '00's and in '14 represent sales of earlier businesses.

The stock has gone in hockey stick mode ... but when you read 10-years of financials and five years of conference calls ... I see evidence that they are rational investors who've been focused for quite some time on building a pretty interesting and hard to replicate platform.

For the company to generate a positive IRR on their +$35M cumulative investments, I estimate it needs to generate profits well north of $20M. So while the stock is expensive against this year's annualized income, against that long term "bogey", it remains quite cheap. And based on talking with experts in the industry, its offering is in quite high demand.

The bottom chart shows BVPS for a company whose current CEO joined in '12, did a major writedown / restructuring and identified one strategy that's bore fruit in '17 and another strategy that they think could bear fruit in '19 (but who knows?).

It's been a terrible stock on account of impossible y/y comps that will continue through 2018. Plus, it's a capital equipment provider in the chip space, so you've got that cyclicality. Their equipment does a fairly commodity task of programming chips. Lots of companies do this. But ... there's more data going into chips + there's an idea that security needs to be programmed into the "root" of a chip = separation between competitors based on speed, reliability and access to security IP.

They've locked up some pretty good IP; in a convo with a frenemy, their technology is solid. Their partner who supplies the IP in the security offering was recently acquired for +$30M valuation (on less than $1M sales). If the buyer wants to get a return on that investment they need our company to produce more equipment.

And all they do, all the time is think about putting value into / squeezing value out of this niche business of providing their capital equipment used to program chips. They solve problems for electronics distributors (Arrow, Avnet, etc) and automotive suppliers (Bosch, Johnson, etc), who need fairly small scale (< 10M) units programmed.

It might remain a terrible stock through 2H18. It might be a terrible stock until their security offering starts to work. That security offering might not work until regulations change.

It might be a terrible stock even when it does start to work, b/c they won't be booking large equipment sales but rather high margin pennies per chip sales. But it seems inexpensive relative to it's future opportunity and it's growing installed base.

Like anything else, both of these companies are investments in unknown and unknowable futures. That they are both managed by teams that have long been focused - and demonstrated an ability to generate - value creation offers the outside investor at least something to hang their hat on, and solve that problem I recognized we investors all face, long ago.

-- END --

ALL RIGHTS RESERVED. PLEASE DO NOT COPY OR RE-DISTRIBUTE WITHOUT PERMISSION. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT IN THE COMPANIES MENTIONED HERE, WHICH I MAY BUY, OWN OR SELL AT ANY TIME.

Tuesday, July 24, 2018

Question sent from reader (QRHC)

I haven't posted in awhile. Companies I've written about and own haven't been operating as expected and their stocks aren't working either, which has lead to some combination of reflection (a good thing) and hiding under a rock (a less good thing). I've been struggling to sincerely articulate the experiences and painful lessons of "getting punched in the face" and hope to post something on that soon.

But I wanted to share my recent response to an email received from a reader on QRHC who asked questions around ...

executive comp ("Do you have any idea what the executive comp plan actually is?"),

commodity exposure ("I am trying to get a sense if it's possible that the recent increase in GM’s is related to commodity prices rather then fundamental profitability improvement"),

the Chairman selling ("it sure does look like Saltz is running for the exits as soon as the stock popped")

and finally about the lack of insider buying ("I can’t seem to find any evidence of Hatch buying stock on the open market even as it traded to $1.00.").

... I'll take the last one first.

On the lack of insider buying, I asked the CEO this exact question the last time I spoke with him, and it was the last time he spoke with me. Putting aside the slight frustration with getting ghosted by management over a layup question, all managers should be aware that avoiding questions is an "amateur hour" technique that's about as useful as a concrete life preserver. It doesn't make questions go away, it just means the askers have to find other sources.

Having poked around some, I don't know why the CEO hasn't been buying shares but I do feel comfortable that he is in his wheelhouse building a mid-market focused business, and that he is surrounded by good executives who know what they're doing.

I'm blind however to whether or not they have the right technology to grow the business, and that worries me, b/c this business needs good technology to scale.

I know that at Oakleaf, technology was key to the turnaround, but they had a CTO who was an MIT grad and is now CIO of XPO logistics. In contrast, it doesn't look like QRHC even has a CTO. A search on LinkedIn reveals two people who fit tech related roles but I'm not familiar enough with the technology departments at Fairfield University nor East Central University in Ada, Oklahoma to judge their pedigree.

According to the CF statement, in 2015 they spent $2M on capitalized software and that should be enough, if well spent, for a good system, but that's all I know. Growing revenues much faster than COGS would indicate a good tech system that obviates the need for more people touching invoices / receivables. Without that, this doesn't work.

In contrast to a management team that appears experienced and well-suited for a small mid-market focused business, the Board appears non-functioning. It is controlled by Mitch Saltz, the Chairman and majority shareholder, even as he sells shares into a guidance # I don't believe they will hit. Presuming he too wants a return on his investment, I wrote letters asking him they re-incorporate from NV to DE to better attract institutional investors and that they add an experienced industry expert to the Board to better monitor management, but he said no.

The exec comp - if that's what you want to call it - can be viewed as an example of the non-functioning Board, something that easily could be fixed if the Board wanted to, but they don't appear to care.

Want to see a vague exec comp plan?

"One or more of the following business criteria for our company, on a consolidated basis, and/or for Related Entities, or for business or geographical units of our company and/or a Related Entity (except with respect to the total stockholder return and earnings per share criteria), will be used by the committee in establishing performance goals for such awards:

(1) total stockholder return;

(2) such total stockholder return as compared to total return (on a comparable basis) of a publicly available index such as, but not limited to, the Standard & Poor’s 500 Stock Index or the S&P Specialty Retailer Index;

(3) net income;

(4) pretax earnings;

(5) earnings before all or some of the following items: interest, taxes, depreciation, amortization, stock-based compensation, ASC 718 expense, or any extraordinary or special items;

(6) pretax operating earnings after interest expense and before bonuses, service fees, and extraordinary or special items;

(7) operating margin;

(8) earnings per share;

(9) return on equity;

(10) return on capital;

(11) return on investment;

(12) operating earnings;

(13) working capital or inventory;

(14) operating earnings before the expense for share based awards; and

(15) ratio of debt to stockholders’ equity."

I think we'd all prefer to see a Board pick three of these and consistently pay on those parameters, at least so shareholders know the targets.

Getting to the last remaining question on commodity exposure, since the company doesn't own fixed assets, I don't believe commodity exposure on its own is a material driver of revenues or margins. A processor that owns fixed assets drives their business on the bill / pay spread of waste oil but here the broker only takes their margin on the total value.

In conclusion, with this investment, I've been focused almost exclusively on the three things that I think make this business work ...

right people

right market

right technology

... in short, management. I am confident on the first two. I have limited visibility into the latter. I've long said that as investors we need to hang our hats on facts that endure even when the market tells us we're wrong or when operations temporarily aren't performing as expected. I feel comfortable knowing what I know and hanging my hat on "this is a simple business with experienced people running it".

But I do think it might be time to elevate some Board and corporate governance issues in my investment weighing process. It certainly can be a more nuanced and potentially effective way of further separating the wheat from the chaff.

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

But I wanted to share my recent response to an email received from a reader on QRHC who asked questions around ...

executive comp ("Do you have any idea what the executive comp plan actually is?"),

commodity exposure ("I am trying to get a sense if it's possible that the recent increase in GM’s is related to commodity prices rather then fundamental profitability improvement"),

the Chairman selling ("it sure does look like Saltz is running for the exits as soon as the stock popped")

and finally about the lack of insider buying ("I can’t seem to find any evidence of Hatch buying stock on the open market even as it traded to $1.00.").

... I'll take the last one first.

On the lack of insider buying, I asked the CEO this exact question the last time I spoke with him, and it was the last time he spoke with me. Putting aside the slight frustration with getting ghosted by management over a layup question, all managers should be aware that avoiding questions is an "amateur hour" technique that's about as useful as a concrete life preserver. It doesn't make questions go away, it just means the askers have to find other sources.

Having poked around some, I don't know why the CEO hasn't been buying shares but I do feel comfortable that he is in his wheelhouse building a mid-market focused business, and that he is surrounded by good executives who know what they're doing.

I'm blind however to whether or not they have the right technology to grow the business, and that worries me, b/c this business needs good technology to scale.

I know that at Oakleaf, technology was key to the turnaround, but they had a CTO who was an MIT grad and is now CIO of XPO logistics. In contrast, it doesn't look like QRHC even has a CTO. A search on LinkedIn reveals two people who fit tech related roles but I'm not familiar enough with the technology departments at Fairfield University nor East Central University in Ada, Oklahoma to judge their pedigree.

According to the CF statement, in 2015 they spent $2M on capitalized software and that should be enough, if well spent, for a good system, but that's all I know. Growing revenues much faster than COGS would indicate a good tech system that obviates the need for more people touching invoices / receivables. Without that, this doesn't work.

In contrast to a management team that appears experienced and well-suited for a small mid-market focused business, the Board appears non-functioning. It is controlled by Mitch Saltz, the Chairman and majority shareholder, even as he sells shares into a guidance # I don't believe they will hit. Presuming he too wants a return on his investment, I wrote letters asking him they re-incorporate from NV to DE to better attract institutional investors and that they add an experienced industry expert to the Board to better monitor management, but he said no.

The exec comp - if that's what you want to call it - can be viewed as an example of the non-functioning Board, something that easily could be fixed if the Board wanted to, but they don't appear to care.

Want to see a vague exec comp plan?

"One or more of the following business criteria for our company, on a consolidated basis, and/or for Related Entities, or for business or geographical units of our company and/or a Related Entity (except with respect to the total stockholder return and earnings per share criteria), will be used by the committee in establishing performance goals for such awards:

(1) total stockholder return;

(2) such total stockholder return as compared to total return (on a comparable basis) of a publicly available index such as, but not limited to, the Standard & Poor’s 500 Stock Index or the S&P Specialty Retailer Index;

(3) net income;

(4) pretax earnings;

(5) earnings before all or some of the following items: interest, taxes, depreciation, amortization, stock-based compensation, ASC 718 expense, or any extraordinary or special items;

(6) pretax operating earnings after interest expense and before bonuses, service fees, and extraordinary or special items;

(7) operating margin;

(8) earnings per share;

(9) return on equity;

(10) return on capital;

(11) return on investment;

(12) operating earnings;

(13) working capital or inventory;

(14) operating earnings before the expense for share based awards; and

(15) ratio of debt to stockholders’ equity."

I think we'd all prefer to see a Board pick three of these and consistently pay on those parameters, at least so shareholders know the targets.

Getting to the last remaining question on commodity exposure, since the company doesn't own fixed assets, I don't believe commodity exposure on its own is a material driver of revenues or margins. A processor that owns fixed assets drives their business on the bill / pay spread of waste oil but here the broker only takes their margin on the total value.

In conclusion, with this investment, I've been focused almost exclusively on the three things that I think make this business work ...

right people

right market

right technology

... in short, management. I am confident on the first two. I have limited visibility into the latter. I've long said that as investors we need to hang our hats on facts that endure even when the market tells us we're wrong or when operations temporarily aren't performing as expected. I feel comfortable knowing what I know and hanging my hat on "this is a simple business with experienced people running it".

But I do think it might be time to elevate some Board and corporate governance issues in my investment weighing process. It certainly can be a more nuanced and potentially effective way of further separating the wheat from the chaff.

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Monday, April 30, 2018

IVTY Proxy: Board Compensation is Shameful

When Christopher Byron died last year, I was reminded of the years I knew him, my first two out of college, when I was an editorial assistant at the (old) New York Observer and he wrote a weekly column about executive compensation.

The obscenity of executive pay at the time was still relatively new and it was awesome to hear him talk about the issue. Now executive comp is an old obscenity, like a grandmother's curse. "Feh!"

Even in our topsy turvy world, it seems that the one thing everyone can agree on is paying themselves raises with other people's money. It is certainly the one issue on which all our government representatives tend to agree. All the more reason to continue to shed light on the practice.

For smaller companies, I typically see Board cash pay in the $10k-$25k range and a few thousand shares. Occasionally you see Boards putting skin in the game, though no examples come to mind at the moment.

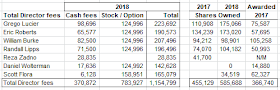

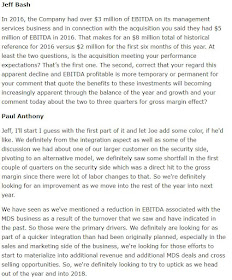

Invuity's latest proxy demonstrates the wrong side of comp, a greedy, do nothing board paying itself an absurd fee justified by nothing. Here is the board comp for $75M market cap company trading at its 52-week lows, whose stock is down 65% over the last 52-weeks, 50% ytd and whose new CEO is trying to talk up better capital allocation to the street.

I'm sure Boards justify these things using comparables but the aspect of benchmarking everyone seems to forgets is adjusting plus / minus from the baseline depending on performance. So I'd be fine with them using a benchmark, just deduct 65%. Oh and by the way, granting oneself $125K worth of shares is not a form of alignment.

Here's the cash comp they intend to pay themselves next year, roughly the same as last year. That the Chairman takes a small cut infers he knows it's excessive, but the cutback isn't nearly sufficient.

The company reports quarterly earnings in a few days and based on the stock's recent performance, I guess the market expects 1Q18 sales below consensus $9.5M and / or management will lower already conservative guidance of 5% topline growth.

It would be pretty dramatic if this happens on top of plenty of drama year to date: The new CEO was announced in mid-February and there was an equity raise in March.

Whatever happens, the new CEO will have to articulate a lucid and reasonable plan, and I expect he will. As I see it, the reasons for owning the company haven't changed much: Great product, selling okay, scaling the marketing curve, with optionality to do much better under better management, and with the whole company selling for less than 2x sales.

Here we are under ostensibly better management and I have been trying to keep my head about even as the stock slides and the anonymous comments pile up on CafePharma. Obviously, I think investors will get paid or else why would I own this, but I think the aspects that I underweighted in my initial analysis, notably the prior CEO's spending ways and the excessive Board comp, takes on increasing weight under the new CEO, and I just keep thinking "The Board should contribute not detract from the new CEO's efforts by making material changes to their comp." I recommend a few changes in the letter I sent today.

***

Dear Chairman:

I was shocked and disappointed to open my Invuity proxy and observe continued excessive Board compensation.

What you pay yourselves even as you’ve overseen significant and material destruction of shareholder value should outrage Invuity’s employees and customers from whom you are effectively taking much needed resources. Furthermore, the extent at which you sell shares and the miserliness with which you personally buy them should outrage shareholders, the majority of whom have lost money on this investment to date.

No doubt, a compensation structure that exists only to enrich yourselves fit comfortably with the norms, cultures and behaviors of the prior CEO, but this has no place in the current strategy of managing capital more efficiently and effectively.

We have a new CEO who is working hard to improve so much prior mismanagement that occurred under your watch and that resulted in the evaporation of capital market credibility. The Board can help him re-establish credibility by following a sane and reasonable compensation structure.

I recommend the following two steps to show faith and confidence in his efforts and in the company in general:

• Take no compensation until the firm starts earning money.

• Buy shares with your own personal money until the Board effectively owns 20% of the company.

Lead by example. Stop this senseless self-enrichment. It will do right by your employees, customers and shareholders and it will materially and beneficially contribute to the company’s new efforts towards a wiser and smarter approach to capital allocation.

Sincerely

The obscenity of executive pay at the time was still relatively new and it was awesome to hear him talk about the issue. Now executive comp is an old obscenity, like a grandmother's curse. "Feh!"

Even in our topsy turvy world, it seems that the one thing everyone can agree on is paying themselves raises with other people's money. It is certainly the one issue on which all our government representatives tend to agree. All the more reason to continue to shed light on the practice.

For smaller companies, I typically see Board cash pay in the $10k-$25k range and a few thousand shares. Occasionally you see Boards putting skin in the game, though no examples come to mind at the moment.

Invuity's latest proxy demonstrates the wrong side of comp, a greedy, do nothing board paying itself an absurd fee justified by nothing. Here is the board comp for $75M market cap company trading at its 52-week lows, whose stock is down 65% over the last 52-weeks, 50% ytd and whose new CEO is trying to talk up better capital allocation to the street.

I'm sure Boards justify these things using comparables but the aspect of benchmarking everyone seems to forgets is adjusting plus / minus from the baseline depending on performance. So I'd be fine with them using a benchmark, just deduct 65%. Oh and by the way, granting oneself $125K worth of shares is not a form of alignment.

Here's the cash comp they intend to pay themselves next year, roughly the same as last year. That the Chairman takes a small cut infers he knows it's excessive, but the cutback isn't nearly sufficient.

The company reports quarterly earnings in a few days and based on the stock's recent performance, I guess the market expects 1Q18 sales below consensus $9.5M and / or management will lower already conservative guidance of 5% topline growth.

It would be pretty dramatic if this happens on top of plenty of drama year to date: The new CEO was announced in mid-February and there was an equity raise in March.

Whatever happens, the new CEO will have to articulate a lucid and reasonable plan, and I expect he will. As I see it, the reasons for owning the company haven't changed much: Great product, selling okay, scaling the marketing curve, with optionality to do much better under better management, and with the whole company selling for less than 2x sales.

Here we are under ostensibly better management and I have been trying to keep my head about even as the stock slides and the anonymous comments pile up on CafePharma. Obviously, I think investors will get paid or else why would I own this, but I think the aspects that I underweighted in my initial analysis, notably the prior CEO's spending ways and the excessive Board comp, takes on increasing weight under the new CEO, and I just keep thinking "The Board should contribute not detract from the new CEO's efforts by making material changes to their comp." I recommend a few changes in the letter I sent today.

***

Dear Chairman:

I was shocked and disappointed to open my Invuity proxy and observe continued excessive Board compensation.

What you pay yourselves even as you’ve overseen significant and material destruction of shareholder value should outrage Invuity’s employees and customers from whom you are effectively taking much needed resources. Furthermore, the extent at which you sell shares and the miserliness with which you personally buy them should outrage shareholders, the majority of whom have lost money on this investment to date.

No doubt, a compensation structure that exists only to enrich yourselves fit comfortably with the norms, cultures and behaviors of the prior CEO, but this has no place in the current strategy of managing capital more efficiently and effectively.

We have a new CEO who is working hard to improve so much prior mismanagement that occurred under your watch and that resulted in the evaporation of capital market credibility. The Board can help him re-establish credibility by following a sane and reasonable compensation structure.

I recommend the following two steps to show faith and confidence in his efforts and in the company in general:

• Take no compensation until the firm starts earning money.

• Buy shares with your own personal money until the Board effectively owns 20% of the company.

Lead by example. Stop this senseless self-enrichment. It will do right by your employees, customers and shareholders and it will materially and beneficially contribute to the company’s new efforts towards a wiser and smarter approach to capital allocation.

Sincerely

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

Tuesday, April 17, 2018

LCA 1Q18 Letter: "On Testing An Investment Hypothesis"

I included this short piece as part of my 1Q18 letter posted on the Long Cast Advisers website.

***

I like to make as few decisions as possible and react as little as possible to short-term changes in price. However, as the largest single client in the firm, I definitely feel it when stock prices go down. And when they do, as they will inevitably, I increase my research to try to better test the hypothesis, because I want to make sure I’m not missing anything while taking advantage of the opportunity to buy more.

Thinking about this, I’m reminded of a wonderful article I recently read in my alumni magazine about the physicist Andrew Ewald’s work on metastasized cancers. I recommend the entire article but this paragraph alone blew me away. It speaks to the amount of time, effort and experimentation involved in simply tracking information that might be useful:

“He reconfigured his microscopes to image hundreds of positions in quick succession while staying in perfect focus. And he replaced the light filters. Microscope designers typically enhance their instruments' resolution by blasting a sample with as much light as possible. But light that bright kills cells. "Bringing in more light looks fantastic for a few images," Ewald says. "Then the sample dies." He took a different tack: He carefully guided the scope's light beams to make each photon do more work. He managed to supercharge his resolution while keeping light levels low enough for cells to survive indefinitely. He wrote software that made the microscope take a picture every 10 to 20 minutes for up to 100 hours. He calls the technique 4-D confocal microscopy—the fourth dimension being time. He calibrated his equipment to collect not just images but numbers—quantitative measures of cells' positions, velocities, and trajectories.”

What an intense and extraordinary amount of work first identifying a problem then testing different solutions. It got me thinking about how investors test a hypothesis related to an investment idea.

All public investors have access to self-reported financial information published quarterly; macro-economic information published regularly by the government (and supplemented by private sector service providers); and their own abilities to reason. These are good primary sources to help form a hypothesis.

We also have access through Seeking Alpha, Sumzero, VIC, et al. to other people’s views on a stock. And of course, the most expedient piece of information is the stock price, which is essentially the aggregate of what everyone thinks.

There is value to knowing what everyone else thinks, but it often serves more as a “bias creating machine” than a “hypothesis testing machine”.

I recently met a PhD psychology student at Stanford who told me: “There’s lots of human error out there, that’s for sure,” which is a nice way of saying something a lot of us probably wonder from time to time. It gets to the heart of my belief that the markets, theorized as an efficient method of price discovery just as often amplifies human error.

If you want to do better than the crowd, you have to do different. With nearly two decades of investment experience, and a foundation of healthy skepticism, a little irreverence and a lot of humility, I think it is possible to sustainably and repeatedly do better than the crowd. The question is: How?

Part of my work, which was informed by my brief experience in 1996 working as a PI for BackTrack Reports, involves interviewing people. Without care, interviews can lend towards biases (small sample sizes, weak connections, etc) but a good source (customers, executives’ former colleagues, competitors who always love to dish dirt, experts in certain fields) asked the right open-ended questions can add value that is not otherwise available elsewhere. It is a sharp relief from talking with other investors who more often than not don’t want to hear or haven’t considered the bad news. (The best ones do, and most likely already know it.)

I know I’m not the only investor who interviews people and I know that as a “hypothesis testing machine” it is imperfect. But I think marrying the quantitative analysis of financial statements with the qualitative aspects of “walking around and talking to people” helps reduce some errors.

Whatever the favored method is, the key is to first figure out what we’re looking for, then try to figure out how to find it. It’s hard and it’s time consuming and you never know if what you’re going to find will add value. I start with asking “where am I wrong” in order to seek out what I don’t know so I can find ways to disprove the hypothesis. Asking the right questions is one of the hardest parts to solving any problem, investing included.

There’s no one answer and we can all find our paths to success. But following a scientific method has tremendous value. I realize that comparing the humble and greedy aspects of business valuations and investing doesn’t hold a candle to cancer research, but in taking a professional and scientific approach to the work, at least we can match the integrity of it.

-- END --

ALL RIGHTS RESERVED. PAST HISTORY IS NO GUARANTEE OF PRIOR RETURNS. THIS IS NOT A SOLICITATION FOR BUSINESS NOR A RECOMMENDATION TO BUY OR SELL SECURITIES. I HAVE NO ASSURANCES THAT INFORMATION IS CORRECT NOR DO I HAVE ANY OBLIGATION TO UPDATE READERS ON ANY CHANGES TO AN INVESTMENT THESIS IN THE COMPANIES MENTIONED HERE, WHICH I MAY OWN.

***

I like to make as few decisions as possible and react as little as possible to short-term changes in price. However, as the largest single client in the firm, I definitely feel it when stock prices go down. And when they do, as they will inevitably, I increase my research to try to better test the hypothesis, because I want to make sure I’m not missing anything while taking advantage of the opportunity to buy more.

Thinking about this, I’m reminded of a wonderful article I recently read in my alumni magazine about the physicist Andrew Ewald’s work on metastasized cancers. I recommend the entire article but this paragraph alone blew me away. It speaks to the amount of time, effort and experimentation involved in simply tracking information that might be useful:

“He reconfigured his microscopes to image hundreds of positions in quick succession while staying in perfect focus. And he replaced the light filters. Microscope designers typically enhance their instruments' resolution by blasting a sample with as much light as possible. But light that bright kills cells. "Bringing in more light looks fantastic for a few images," Ewald says. "Then the sample dies." He took a different tack: He carefully guided the scope's light beams to make each photon do more work. He managed to supercharge his resolution while keeping light levels low enough for cells to survive indefinitely. He wrote software that made the microscope take a picture every 10 to 20 minutes for up to 100 hours. He calls the technique 4-D confocal microscopy—the fourth dimension being time. He calibrated his equipment to collect not just images but numbers—quantitative measures of cells' positions, velocities, and trajectories.”

What an intense and extraordinary amount of work first identifying a problem then testing different solutions. It got me thinking about how investors test a hypothesis related to an investment idea.

All public investors have access to self-reported financial information published quarterly; macro-economic information published regularly by the government (and supplemented by private sector service providers); and their own abilities to reason. These are good primary sources to help form a hypothesis.

We also have access through Seeking Alpha, Sumzero, VIC, et al. to other people’s views on a stock. And of course, the most expedient piece of information is the stock price, which is essentially the aggregate of what everyone thinks.

There is value to knowing what everyone else thinks, but it often serves more as a “bias creating machine” than a “hypothesis testing machine”.

I recently met a PhD psychology student at Stanford who told me: “There’s lots of human error out there, that’s for sure,” which is a nice way of saying something a lot of us probably wonder from time to time. It gets to the heart of my belief that the markets, theorized as an efficient method of price discovery just as often amplifies human error.

If you want to do better than the crowd, you have to do different. With nearly two decades of investment experience, and a foundation of healthy skepticism, a little irreverence and a lot of humility, I think it is possible to sustainably and repeatedly do better than the crowd. The question is: How?

Part of my work, which was informed by my brief experience in 1996 working as a PI for BackTrack Reports, involves interviewing people. Without care, interviews can lend towards biases (small sample sizes, weak connections, etc) but a good source (customers, executives’ former colleagues, competitors who always love to dish dirt, experts in certain fields) asked the right open-ended questions can add value that is not otherwise available elsewhere. It is a sharp relief from talking with other investors who more often than not don’t want to hear or haven’t considered the bad news. (The best ones do, and most likely already know it.)

I know I’m not the only investor who interviews people and I know that as a “hypothesis testing machine” it is imperfect. But I think marrying the quantitative analysis of financial statements with the qualitative aspects of “walking around and talking to people” helps reduce some errors.